How often do I need to trade?

Summary: Our algorithm generates new allocation weights every week. However, you have the flexibility to implement these changes on your own schedule - weekly, monthly, quarterly. We generally recommend to update your portfolio on a monthly basis. Our algorithm will send you a notification email depending on your chosen update interval, and it will indicate whether the model portfolio has changed to such a degree that it requires an adjustment in your own account.

Our model portfolios react dynamically to changing market conditions in an effort to achieve superior performance while maintaining diversification across asset classes. In general, our statistical models are updated each week on Monday, after the US market closes. However, this does not mean that you need to adjust your portfolio positions every week. On the Settings page, you can choose your preferred update interval: weekly, monthly, quarterly. Based on this interval, we will send you an email reminding you to check for the latest portfolio update. However, you will not have to adjust your portfolio after every interval, as our algorithm tries to avoid very small trades to save transaction costs. Below we explore how the number of expected portfolio adjustments changes as a function of your preferred update interval and as a function of your initial investment. We will further look at how the update interval affects the performance of your investment, explaining why our default update interval is one month.

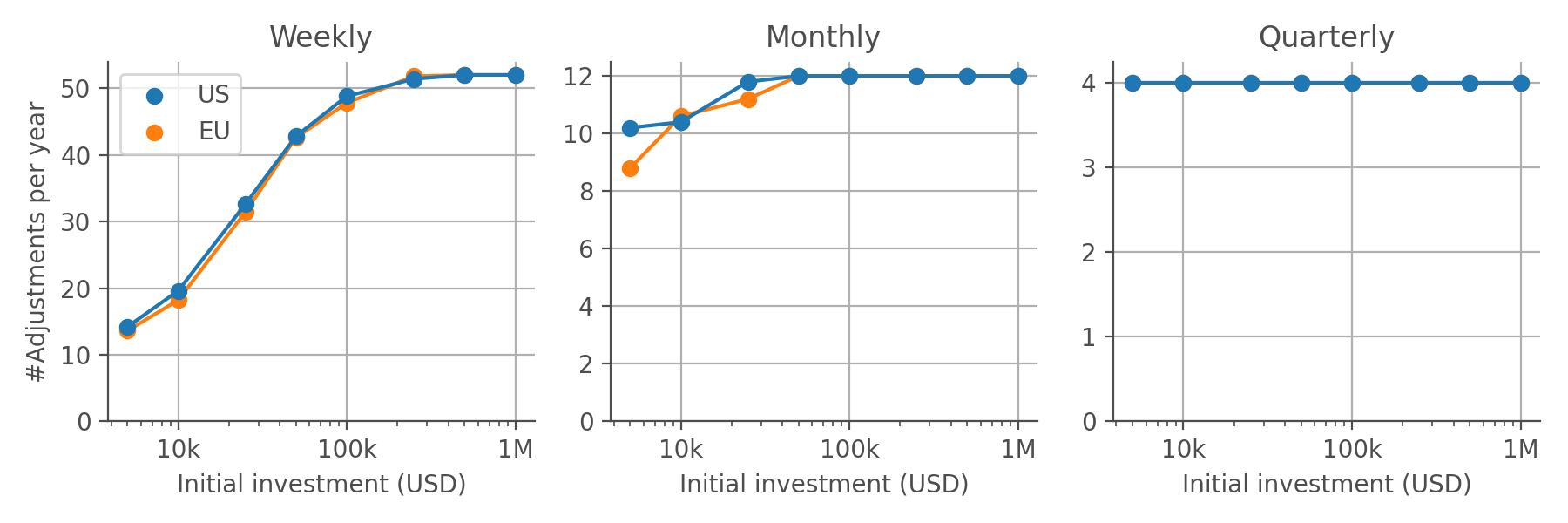

Number of portfolio adjustments

Since our algorithm tries to avoid very small trades that incur transaction costs but do not change the performance of our portfolio in a significant way, the number of portfolio adjustments depends on your initial investment. To simulate this effect, we assume that you invest between $5,000 and $1,000,000 in our Basic Portfolio, starting in January 1997. We further assume typical costs of trading, specifically a brokerage fee of $5 per trade and 0.1% spread cost. The charts show the number of portfolio adjustments per year for the US version (blue) and the EU version (orange) of our Basic Portfolio, and the update intervals weekly (left), monthly (center), and quarterly (right).

Weekly, monthly, or quarterly?

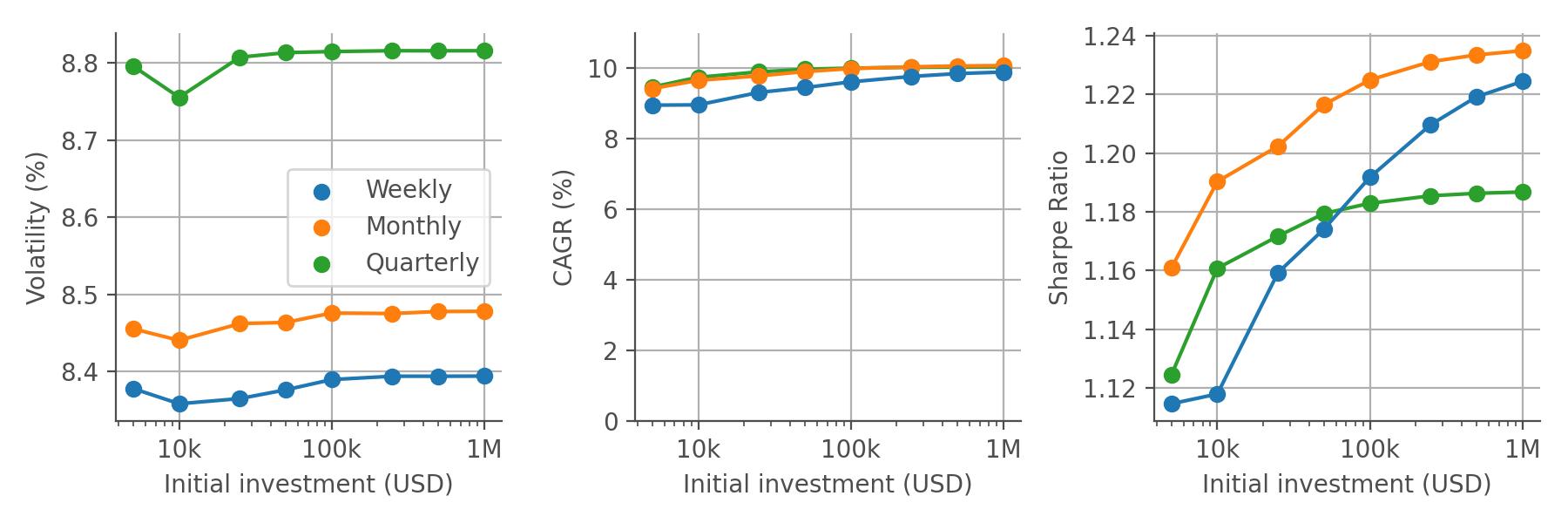

So far, we have only looked at the number of portfolio adjustments, but not at how the update interval affects the performance of the Basic Portfolio. In principle, the more often you adjust your portfolio to our model portfolios, the more closely you will follow the decisions of our algorithm, and the better the performance should be. However, transaction costs and fees can alter this idealized view. Again, we run simulations to find out which update interval performs best, assuming a spread cost of 0.1% and a flat brokerage fee of $5 per trade. In this case, we simulate a longer investment period, starting in 1997, to obtain more stable performance statistics. For initial investments of $5,000 up to $1,000,000, we track the volatility (left) of our Basic Portfolio, as well as its CAGR (center), and its Sharpe Ratio (i.e. its risk-adjusted return; right).

As expected, the volatility of the Basic Portfolio increases as we update less frequently and thus follow the algorithm less strictly. However, due to spread costs and brokerage fees, updating weekly decreases the growth rate of the Basic Portfolio quite significantly. The Sharpe Ratio combines both of these results, and shows that the intermediate, monthly update interval yields the maximal risk-adjusted return. In general, the lower your trading costs, the more attractive it becomes to adjust the portfolio more often, but for typical trading costs, the monthly update interval will be the best option.